"I am rich".

This is a rare or I must say an impossible to hear claim in Indian middle class society. Nobody ever feels that they are rich or maybe rich enough to admit it in their social circles. Contrary to my affinity towards non-material world of core values, here I am thinking more in terms of money and material possessions.

This thought struck me recently. I was reflecting upon a usual difference of opinion with my wife, on a petty matter that briefly entered the territory of family finances.

Who are the riches in our society? If I ask this to regular people in Indian middle class, answers might be Ambanis, Adanis, Warren Buffet, Elon Musk, Jeff Bezos, Shah Rukh Khan, Birlas, Tatas, some politicians, cricketers, or some other famous personalities in public domain. If I probed further and asked if only these few people were rich, I may further get an answer that there may be many others who are not as popular as the ones cited earlier, like Lakshmi Mittal (ArcelorMittal), Bharti Mittal (Airtel), Mukesh Bansal (Flipkart/Cultfit), Deepinder Goyal (Zomato), Nithin Kamath (Zerodha), big bulls like Jhunjhuwalas, Radhakishan Damani (D-Mart) etc. And then there may be many who are not active in public domains.

I and many other people belonging to the middle-class might never make as much money as these riches. Does this mean that we can never call ourselves or maybe at least feel "rich", in plain terms of money? Does this mean that we should start calling ourselves "poor"? But if we are "poor", then what are our daily helps and hundreds of blue collar workers who we see around us?

I think that we can safely say that we are neither rich nor poor. Most of us should belong to this "nobody" category. But then within our circle of nobodies, we often think that others have more money and more resources than us, which makes us feel "relatively" poor. This often leads to feelings of inferiority, and inexpressible (but having feelable vibes) emotions like envy, anxiety, insecurity, insufficiency, ill-fate, self-doubt etc. We see others, from our clan of sufficiency, post their seemingly "rich" experiences on social media. This makes us either feel compelled to try live similar "rich" experiences or feel sad about our "poor" selves. We seldom realize that we ourselves live "rich" or maybe even "richer".

We don't realize it too often that we are "rich". Even if we realize this accidentally, we want to soon erase this thought from our memory. We feel insecure that holding this thought may either jinx our richness or may make us a careless spender. It may make us less committed to try and earn more money, and stay rich.

In the vicious circle of external influences and personal insecurities, we stop realizing or cherishing the actual experiences of our rich lives. Whatsoever amount of money we may possess, our glass is always half-empty. If half a glass of water cannot quench my thirst, how will I even think about sharing a spoonful of this water with the ones whose glasses are empty or with the ones who don't even have any glasses to hold the water.

I am not a brilliant scholar who studied in IITs, IIMs, or Harvard, or Stanford. I am not blessed with great looks. I am not born in a family with great businesses or great wealth. I am not a great sportsperson. I have not been brilliant about maintaining a good body and good health. I am a simple Indian middle-class mediocre in all these aspects. With this mediocrity how can I expect from myself, or rather for myself, to be exceptionally wealthy like the riches whom I mentioned earlier.

If understood and capitalized well, mediocrity is a bliss. (Maybe I'll explore this "mediocrity" further, in more detail, in a later post). If accepted with grace, mediocrity helps us live a very happy, peaceful, and fuller life. If we acknowledge and respect our mediocrity, it can make us cherish our "richness" more often than ever.

Like other aspects of my life, my career story has also been mediocre and does not have many star-moments. In fact, for a considerably long period of time, I've been earning very below-par salaries when compared to the market averages at different points in time of my IT career. In 2017, I took an approx. 25% cut in my salary. This was out of my insecurity of possibly losing my job because my employer had no projects left to put my technology skills to use. My then ongoing project was stalled suddenly because of USA's sudden policy tightening on IT outsourcing to India. For the next 5 months, I drew salary from my employer without contributing to its revenue. My employer was trying hard to cross-train me, along with others like me, into non-tech, services-only roles. The idea was to make us contribute to the company's relatively more stable revenue stream of services-only offerings to customers. The change of role and the related work stream seemed tough to my mediocre and ageing learner mind. At this time, my son was less than 1 year old. We lived in a humble 2.5 BHK on rent, in a not-so-rich looking neighborhood. Thoughts like "how I'll manage my household if I did not earn for a few months.." haunted me bad. The stress eventually led to a 2-months long fever which was not attributed to any viral infections or known flus. Out of extreme insecurity and desperation, I decided to switch to a safer employer who offered almost 100% job guarantee for my tech skills. In that moment, I just didn't care about the fact that I was switching to a much lower salary than what I used to get before.

The salary cut in 2017 had a cascading effect on my relative standings with respect to average salaries at my levels of IT skills and experience. In 2021, during a casual hangout, I asked one of my close neighbors - "What should be my ideal salary?". She was then a Director in a globally well-known IT firm. Surprised at the openness of my question, and with a lil hesitation, she told that my salary should be around 39 lacs. I told her that it was 26.

The lady had a mixed expression of pity and wonder. She might have felt a lil envy as well, of the fact that I was still living a visibly "rich" life, maybe because of the grants/inheritance from my father. This lady lost her father quite early in her life, but she's blessed and rightfully proud to have a success story of being a self-made person. She has achieved great heights in both professional and social life, without any financial support and/or parental guidance along her way. Rightfully, she belonged to the clan of people who may not think very high of getting financial backings from family and then living a lavish rather than the otherwise affordable mediocre lifestyles.

My father is a man of very strong core values and principles. I have written a bit more about his values and related life stories in one of my older posts When Dreams Come True... My father held on to his core while he moved from his revolutionary youth into the binding family life. He didn't abandon his resolve to serve the country by serving his immediate society or community. He retired from a central govt. financial institution that manages all govt. spends in agriculture and rural development sectors of our country's economy. He held on to his principles of honesty and sincerity, and maintained a clean conscience as he moved up to very powerful ranks in his job. Like my grandfather, he didn't accumulate as much wealth as he could by taking undue advantages of his positions at work. What he did accumulate was a great sense of managing personal finances, putting them to righteous use, and multiplying whatever he duly earned, in a very organic manner. His life examples can be used to showcase how, irrespective of how much we earn, we can satisfy our personal needs, aim for a realistic future, save sufficiently for the future, and then also contribute our money and resources for the betterment of our society. He exemplified that we always owe to our society and to our country at large. We do not need to be "crazy" rich to have this conscience.

Ever since I started earning, my father has been telling me to save as much as I can. He acknowledges that private sector jobs like mine do not have any job security, and any good pension guarantees like govt. jobs. In the starting few years, he even encouraged me to apply for suitable openings in his as well as other govt. institutions. In 2010, there were 3 open positions in his bank. More than 3 lac candidates applied, 10 made it to the final interview round after two screening tests. I made it to the last 10. I desperately wanted that my father willingly pulled a few strings to help me clear the final round. Just a day before the interview, I asked him, very hesitatingly, if he did speak to someone. He said no. He told that my merit had brought me to the final 10, I'd make it to the final 3 as well if my merit and destiny warranted. I could not clear the final round. Like I missed the IIT overall cut-off by 3 marks, back in 2005, after clearing the individual cut-offs in all subjects in the finals. I missed it like I missed admission to a reputed college of MBA, in 2009, when my turn to claim the admission was next to the last in the final round of counselling. But I still ended up becoming "rich" :), how?

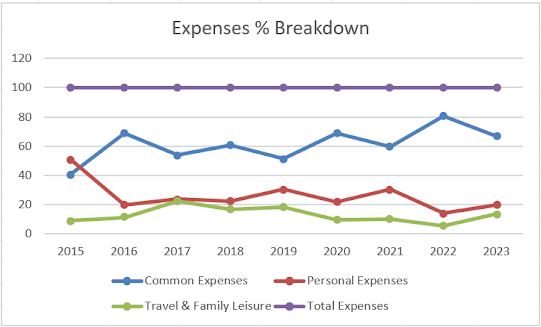

In the following graph, I have mapped important parts of my financial journey over last approx. 10 years. While it's a simple graph which can be understood by normal folks, I'll mention and explain some key observations and inferences that can help visualize my journey of becoming rich. I've masked the numbers of the y-axis deliberately because of practical reasons and impractical insecurities :). The big 0 though marks the apt value at the intersection of both the axis.

Tracking Expenses

Respecting Personal Discretional Expenses

- Personal Expenses - my and my wife's pocket moneys. We can spend this on anything without having to explain or justify this expenditure. This includes shopping, parlor, spa, dine-outs, movies etc. We review and keep increasing our pocket moneys as per the dynamics of our household income as well as inflation. We have been able to maintain a consistent percentage of these expenses to satisfy the always craving child inside our individual selves.

- Travel & Family Leisure - Like a modern couple, we want to travel and create beautiful picture memories, both to look back and cherish later, and to tell happy stories and experiences in our social circles. So we allocate a mutually agreed portion to travel. Leisure includes celebrations like birthdays, anniversaries, festivities etc. Contrary to the visibly restrictive nature of this allocation, it liberates us and brings us more joy and freedom to spend on any and everything while enjoying, coz we know we've planned it well and these spends won't dent our budget. We've travelled and enjoyed vacations in Kashmir, Goa, Jaisalmer & Jodhpur, Mumbai, Shimla, Rishikesh, Sikkim, Kerala, Puducherry, Mysuru, Madikeri, Chikkamagaluru, Kodaikanal, Ooty, and many weekend destinations around the places where we've lived.

Influencers and buzzers keep poking that we've never gone International or never celebrated in some fancy ways. I am convinced that we didn't have any less fun than what we'd have had in these influenced ventures. I'll go on an international trip when the want comes to me intrinsically, organically. At times, my wife falls prey to these influences. Then I tell her that she can go if she really craves to go, but I won't be able to come along and enjoy until the call was organic. Anyways, budget for our solo or family travel ventures is already sorted and not a thing to worry about :). - Common Expenses - These include essentials like rents & society dues; electricity, gas, phone, and other utility bills; vehicles' maintenance & fuel; insurance premiums; healthcare & hospitalization; income tax, property tax and other govt. dues; groceries; salaries of house helps; home repairs & decor etc. Like my father, I have a taste of getting quality woodwork done in my house. We've spent nicely on big woodworks in 4 out of our last 10 years of being together. Along with these essentials, common expenses also include following spends which can be considered personal but I considere them essential for the family, at large:

- Health Hygiene - We've spent thoughtfully on bettering our health by subscribing to various fitness programs like Cult, Curated Diets, Gym, Naturopathy etc. The results may not have been that great, but we cherish the fact that we consistently try.

- Professional Development - We've spent consciously on learning and gaining more knowledge. While I've spent majorly on books and newspapers, my wife has done multiple professional courses to add longevity to her dental practice. Also, as Modern Parents, we've not held back from spending on and trying various add-on courses for our now eight years old son. At a late stage in my life, I considered this to also include the consolidated loss that I booked while trading in Indian stock markets for around 6 years, before arriving at a trading strategy that has helped me earn consistently via investing in the markets.

30% Savings Rule and Equity Investing

Avoid Borrowing from Unrelated Entities

Like his other simple but great lessons in personal finance, my father taught me to avoid institutional loans as much as I could. He ensured that I have not taken a single penny of loan, and have not paid a single penny of interest, so far in my life.

Until a few years back, like many of my peers, I was possessed by the self-elating idea that "I will be a self-made man. I will not take or ask for a single penny from my parents. I will build all my assets myself..". I don't remember under what influence I picked this idea and then got stuck to it. I never cared to review or validate it. Whenever my father spent any money on me, I used to make a note thinking I'd repay soon, like an informal loan. Maybe early years of adulthood and filmy dreams shaped the way I imagined myself as a matured, well-earning, well-settled, and an enviable IT corporate. Only recently, I started relieving myself of the burdens of these unwarranted and unthought expectations. In fact, now I find this expectation lacking rationale, at least for the majority of "mediocre" adults like me.

I can't understand why we are happy to borrow from a bank or an unrelated and profit-centric financial institution, at extremely high interest rates, when our own parents have the money to help us. Why do we opt in to pay EMIs that settle the interest first and then the principal, over many years, when we can simply borrow (if not take) the required money from our parents. Why do we opt for paying almost 50-100% of our principal as interest? Are we not trying to satisfy our false ego by doing this? Which fellow social idiot will worship us for winning this loan vs parental help battle?

Formal loan is understandable if our parents or close ones do not have the required financial resources to help, or if our relationship with parents is strained. But this is not the case for majority of the workforce that graduated in or after the year 2000. I don't understand why we need to wait for our parents to die before we acquire all of their unutilized financial assets and then, not knowing completely what to do with those assets, use them partially or completely to repay our debts. And then keep hoping that our respects for the help reaches them through our occasional remembrances of them. Why can't we let them help us and repay their interest by giving them our time, attention, care, and respect, if and when they seek it in their lesser active or elderly years. It's easier than living with the clout of debts.

My father wanted me to have an intent to be financially independent. He encouraged me to save and afford my own long-term assets and big expenses. But whenever I needed a loan, which I could plan and repay from my income, he intervened to save me from the institutions and their vicious circles of EMIs. Over the last 10-15 years, without factoring in the minor exchanges that ought not be counted within a family, he's given me an approx. 1.4 crore rupees. Major chunk of this amount went into buying my house in 2018. This was followed by my rare but expensive indulgence of buying a Tata Safari SUV car in 2022. The remaining amounts I've invested in the stock market, with my refined trading strategy.

Whenever I try to repay or make any big expenditures for him, he says he has enough and asks me to better save the amount and manage it sensibly for my future. I know my peers who've literally "richer" fathers but they still have long running loans, with amounts running into 80-90 lacs or even more than 1cr.

The orange line in the first graph shows how he always stood behind me, to save me from being pushed into the trap of debt and external borrowings.

Giving Back to the Society

- During my younger earning years, I started with bringing together my big extended families of 5 paternal uncles. Not all of my paternal uncles and their families were "rich" like us. And most of them remained aloof, out of routine busy natures of individual lives and the impractical insecurities. My father always wanted to bring his and his brothers' next generations together. But when he used to float the idea of get togethers in the family, individual egos clashed on pity matters like - how to aptly invite respective son-in-laws from every brother's family; how and what to gift the son-in-laws and daughters to offer respects as per the traditional "baniya" culture; how to split the expenses; etc. These things used to spoil the whole spirit, killing the whole idea.

Sensing my father's long standing social want, I started celebrating my grandfather's birthday every year. I did this with the disclaimer that all expenses would be borne by me. Obviously, my father jumped in and bore all expenses himself, but he was very happy with my intent. He had now found an emotional support to overcome the evil egos within his family. My father and I used to invite my entire extended family in the celebrations. Everyone felt so warm and nice to come together and celebrate like one big family. There were some "baniya" ego-clashes but they seemed small and got washed away with the bigger joy and happiness. In one of the post celebrations exchanges of pleasantries, my cousin sister complimented me with the remark "Like father like son..". I cherish that as a fulfilling reward for my efforts.

The celebrations stopped in 2016, when I moved to Bangalore. But even now, some or the other family members keep remembering those happy times. Sometimes they share their feelings of missing the togetherness of those celebrations. - After 2 years of settling down in Bangalore, and after having assessed my long term career and life prospects, I decided to buy my own house in the city. This was towards the end of the year 2018. I planned for a bank loan but, like I mentioned earlier, my father intervened and sponsored majority of the purchase. My apartment has 101 flats. At the time of my purchase, it was around 12 years old with most of the flats occupied by their first or second owners. It took me around 2 years to settle in the apartment and understand the social atmosphere there. I was surprised that there was not much sense of community-living in my apartment. Undeclared small social groups existed, mostly based on north-south cultural divides or out of unresolved past differences of opinions among.

In 2020, driven by my inherited drive to serve the community, I joined the Management Committee of the Resident Welfare Association (RWA) of my apartment, as a non-executive member. I wanted to understand the polity that was driving the community, so I did not hold any of the executive posts in the committee. After joining the committee, first project that came to the team was that of painting the entire apartment. The executive members discussed and assessed the estimate expenditure to be around 65 lacs. This looked absurd to me. I challenged the estimate and opted to be a part of a sub-committee that was then formulated for the task. Working alongside 2 other members, I brought the quote of around 35 lacs and got the project started. This gave me an initial sense of the lack of competence, intent, or financial prudence in the executive members of the committee. The painting got completed in 2 years with a net cost of around 36 lacs.

Over the course of a few months after joining the committee, I became aware of the fact that the financials of my apartment had not been audited by an independent auditor, for the past many years. Also there were abstract spendings that did not reflect in the general upkeep of our apartment estate. But then, towards the end of 2020, Covid-19 struck the entire world.

Like almost everyone in the world, my community also did not have any clue about how to handle the situation. I was also scared and confused, personally. I acknowledged my ignorance and fear of death. I contemplated and thought that the best I could do is individual precaution and then trust the country's govt. and civic authorities in terms of following the guidelines that were issued to the general public. I understood the policymakers' intent of issuing "guidelines" and not the restricting "rules" or "laws". They respected the fact that an individual's dignity, integrity and personal circumstances could not be remote-controlled by "constraining" orders and rules. This in a situation when the policymakers themselves had an almost zero understanding of the situation at hand.

While people were already stressed and doing their best to their individual capacities and understandings, the executive committee members of our apartment RWA started formulating and imposing abstract rules on residents' individual conducts. This added to the stress of already helpless and locked-down residents. When I challenged the rationale of these rules, I was voted out by another abstractly designed voting mechanism, which was claimed to be "democratic". I validated my counter-points with few other residents and then voiced them in the community discussion forums. However, the members who strongly agreed with me in personal one-to-one conversations remained silent on the discussion forums. They did so partly because of the fear that the debate would expose them to the judgement of an otherwise indifferent community, and add to their existing stress. Their silence made my concerns to be interpreted as minor disagreements of a few in a bigger social scheme of things. The others who were paranoid with their own fears, and some intellectuals who were missing daily soaps in their self-imposed confinements, sided with the committee and justified imposing it's restraining rules over the residents. They didn't bother challenging the rules coz they applied to only those "idiots" who dared to step out of their flats or the apartment. I continued to push my opinion that having all other daily, physical, public works at hold, the committee should focus on doing the important online tasks like completing the pending audits and completing other statutory and regulatory compliances for the apartment. On this again, the silents remained silent and the paranoids did not pay any heed.

To handle the Covid situation, I proposed that we collected relevant data like age, blood groups etc. of our residents so that required support could be provided to affected members. I proposed collecting data via Google Forms and try coordinating with healthcare providers to organize Vaccination camps in our apartment. But all this was killed as a mutiny of a member who was frustrated with the executives. Without any support from committee, I pursued my plan to collect data. Initially only about 30% of the flats submitted the data. These majorly included the silents. I kept publishing the stats around the data collected, which led to a gradual increase in the numbers. In parallel, I started approaching hospitals in the vicinity to help organize vaccination camps, as and when the vaccines would be ready. Looking at the low numbers from my apartment, I collaborated with similar-sized neighbourhood apartments to generate numbers that could get the attention of the healthcare providers to draw them towards our community. Finally, out of this collaboration, I got to know that there was a vaccination camp in a nearby apartment which was 5 times the size of our smaller apartments. I reached out to the RWA committee of that apartment and got the permission to send my community members for vaccination. I published the received permission to my community and got around 10-15% of my apartment residents vaccinated. This was followed by another vaccination camp in which I got another 15% members of my community vaccinated, along with all blue collar staff that worked in our apartment.

I felt very happy and proud to be able to help my community, during a grave and never-seen-before crisis. My community started seeing sense in my approach. Having proven myself true to my words, I again pushed my apartment committee to enlighten the community on the state of our RWA's finances. Finally, after my repeat persuasions, they called for a virtual Annual General Meeting (AGM) in June 2021. Once again they presented an unaudited balance sheet, and finally quit the committee. Elections for the new committee happened and I was elected as the President of our RWA.

One month into taking the office, my new committee realized that the numbers presented in the AGM were not true to reality. We realized that we had only enough funds to pay our apartment's utility bills for 2 months, after which we'd go bankrupt.

What followed was a revolutionary journey, both for my apartment and for my personal self. I hope I will cover this entire journey in a later post, but following are a very few of the many never-expected things that happened to my community in the next 3 years of my Presidentship. - All owners of 101 flats of my apartment contributed more than 40000/- per flat, to bail our apartment out of bankruptcy. This was on top of the regular maintenance of around 60000/- that they paid annually.

- Even though my team started with almost zero money at hand we were able to do major repairs and improvements to the infrastructure. This includes

- Refurbishing 5 out of 6 lifts.

- Replacing swimming pool tiles and pump motors.

- Upgrading STP with modern and latest specification machinery.

- Fixing dysfunctional fire fighting systems via a major overhaul and getting Fire Safety clearance from civic authorities.

- Fixing and servicing apartment generators.

- Replenishing Kids' Play Area sand with superfine and natural sea sand, rather than cheaper and now prominently used machine sand which is not good for kids.

- Upgrading CCTV systems to latest standards, increasing coverage from 30% to more than 80%, approximately.

- Building long pending front compound wall of the estate.

- Fixing dysfunctional amenities like Steam, Sauna, and Snooker.

- Installing safety nets in lobbies of all blocks.

- Even with the major repairs that demanded major expenses, we generated a cash reserve of approx. 30 lacs, from the starting zero. This was done by

- My team's experience and innovative ideas to execute civil works.

- Recovering long pending dues from seasoned defaulters.

- Streamlining dues collections and flat-wise reconciliations.

- Converting 80K subscription fee for a community management software to 1 lac guaranteed ad revenue.

- Engaging digital ad vendor to install digital ad screens and get monthly rents.

- Reviewing contract and increasing rent for a telecom vendor's tower infrastructure hosted in our apartment premises.

- Cleaning and maintaining guest rooms like never before, making them more attractive for residents to pay and book for their guests.

- Parking slots allocated to all 101 flats were diligently reviewed and reallocated. Confusions regarding parking allocations had caused major stresses to both residents as well as non-residing owner members of the RWA. Cycle stands were installed in available free spaces in the parking area, for cleaner and clutter free parking of bicycles.

- In 2022, during the 3rd wave of Covid-19, 40+ flats were provided focused and personalized care by the RWA. Instead of paranoia about personal safety, there was a fresh sense of helping our impacted neighbours by offering food and essentials during their confinement. I collaborated with BBMP to conduct Covid-19 RT-PCR tests for all residents, at our apartment premises itself.

- National festivals - Independence Day and Republic Day were celebrated every year at a scale that only grew bigger and better every year. Cultural festivals like Ganesha Chaturthi, Diwali, Holi, Krishna Janmashtami, Hanuman Jayanti, Shri Ram Mandir Pran Pratishtha were celebrated with joy and energy that were experienced never before in the community. Nobody in our community ever thought that we'd organize DJ nights in our apartment premises, not once but twice, with even seniors grooving to the beats on the dance floor.

- Trying to create a platform for everyone to just walk in and gel within the community, I started a simple initiative of serving Tea and Biscuits every Tue and Fri afternoon, at the beautifully landscaped first floor common area of our apartment. Much beyond my imagination, the tea acted like a catalyst that amalgamated feelings of care, childish naughtiness of seniors, fun of kitty parties' and picnics, joys of celebrating golden and diamond jubilees, and humane connections into an infallible sense of staying together like one big family.

My journey as the community's President has been very eventful and rewarding. It had its due share of pain alongside the rewards. Maybe I'll capture all highlights of this journey in a later post. But, with the above key highlights, I am quite satisfied that I have been able to give back to my society, a bit if not too much.

- Beyond my extended family and apartment community, I have been able to extend help to more people in my circles of influence.

- I have given approx. 19 lacs of interest free loans to my and my wife's colleagues, to save them from the institutional debt traps. Some of these were for contractual civil works that were related to noble social causes.

- I recommended my carpenter to friends and relatives, and got him work orders worth approx. 35 lacs.

- In certain dire needs and critical circumstances of life, I was able to raise crowdfunds of more than 1 lacs for my apartment's staff. This happened on more than one occasions. In both the instances, I was happily surprised that people honoured my requests, maybe because of the relationship of trust and care that I was able to build with all of them.

- I share newspaper articles on personal finance management with a big group of people. These articles are easy to read, understand and relate, and are extremely helpful in getting one started on a journey towards better financial health. Along with these articles, I share my experience of investing and my regular trades in Indian Stock Markets. So far, I have helped my peers earn an approx. 3 lacs, if I go by what they tell me when I casually ask them on how much money they've been able to make from my tips and advice.